Financial freedom is very specific to the individual. But let’s start with what it means to me so everyone is on the same page here.

Cash Flow from Assets (CFA) Expenses.

Meaning, your cash flow that you receive monthly is greater than your monthly expenses. At that point, you no longer need to sell your most valuable asset (time) in exchange for dollars to cover your monthly expenses (food, shelter, clothing, transportation, travel, and Starbucks).

Why Financial Freedom? “Money is not as important as Oxygen, but it ranks right up there.” Zig Ziglar.

So here are the top habits that will set you free so that you can spend more time in a hammock if you so choose.

1. Set Life Goals

What is financial freedom to you? A general desire for financial freedom is really too vague, and will lead to procrastination and lack of direction in your life. You must be specific. For example, if you find that your living expenses are $6000/month, but want to also save $2000-$4000/month, maybe you decide that you are completely free at $10,000/month. Now your financial freedom ticket actually has a specific number for you to work with.

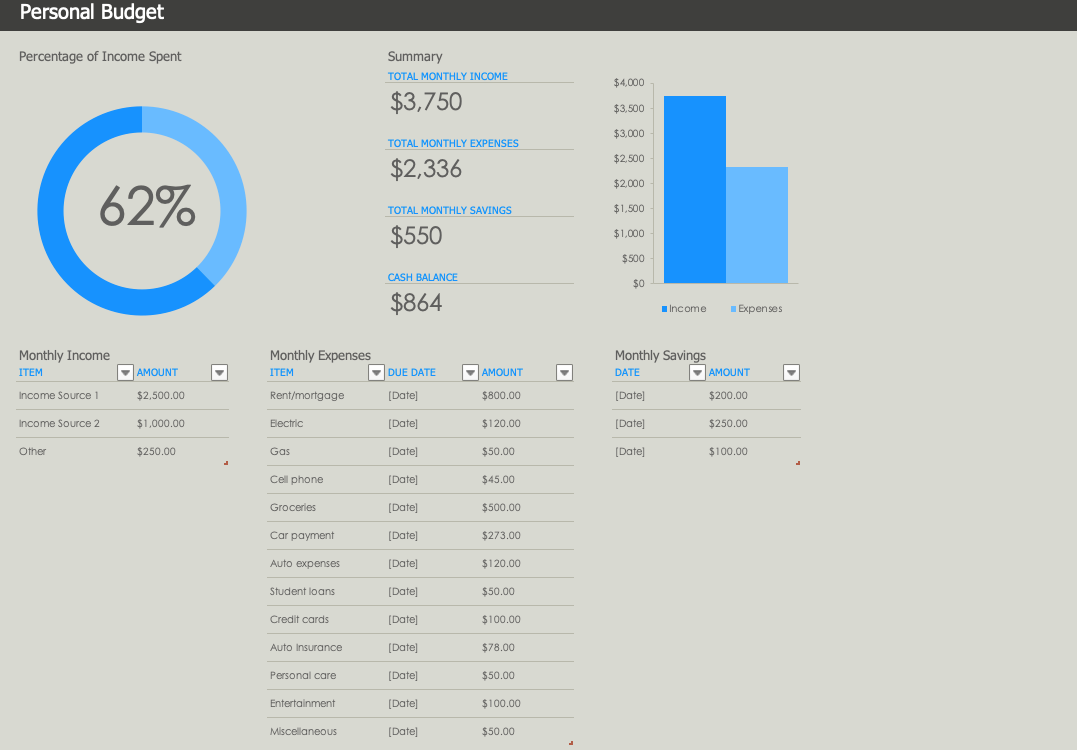

2. Make a Budget

Making a monthly household budget every year and tracking your actual expenses against the budget is absolutely key. Here is an excellent monthly tracker in Excel Templates for everyone, and there are thousands more templates to choose from. I learned a very good lesson from being an engineer for the last 25 years, and that is what doesn’t get measured, does not get paid attention to.

3. Pay off Credit Cards in Full

Credit cards and other similar high-interest consumer loans are absolutely toxic to wealth building. I’m not an advocate of shredding your credit cards because I believe in establishing a superior credit rating to have access to cheap money. But make it a non-negotiable to pay off cards in full each month. If a credit card company makes a dollar in interest from you or any finance charges you should be morally offended.

4. Pay yourself First

Every month pay yourself first; ideally the same day you receive a paycheck. Take full advantage of your employer’s 401k plan and any matching contributions made by the employer. Have an automatic withdrawal to a brokerage account and an automatic withdrawal to an emergency fund in addition to your company’s 401K. Never allow your hands to touch it to alleviate temptation. The future you, will appreciate these payments, which will reap the rewards of compound interest.

5. Start Investing Now

Bad stock markets or bubbled asset prices can make you question whether now is a good time to invest. Historically there has been no better way to grow your money, and monthly cash flow, than through investing. The magic of compound interest will help your next egg increase exponentially over time, but you need a lot of time to achieve meaningful growth. Increase your SAVINGS RATE – building wealth and cash flow has little to do with your income or investment returns and more to do with maximizing your savings rate and letting compound interest work for you.

6. Watch Your Credit

Your credit score determines what interest rate you are offered when you buy a home to live in or decide to finance a rental property. Do not take your credit score lightly; it should be a medal of honor you proudly display when borrowing from a bank. Freeze your account on all of the credit reporting websites (Equifax, Experian, TransUnion) to prevent nefarious persons from stealing your profile information, opening credit lines and running your credit down. This can take years to recover from and can be prevented by freezing your accounts.

7. Negotiate Everything

Many Americans are reluctant to negotiate for goods and services, worrying that it makes them look cheap. Overcome this cultural handicap that could save you thousands each year. Think of every dollar like a financial freedom soldier; they will do the work so you don’t have to. I always ask for discounts and wait… in most cases the person on the other end will work very hard to save you money, but you need to ask.

8. Continuous Education

Review all applicable changes in the tax laws each year to ensure that all adjustments and deductions are maximized. Keep up with financial news and developments in equities (stocks), real estate, and the debt market (bonds). The best investment with the highest returns is financial education; invest in your knowledge. Pick a few areas that interest you the most and take classes to further your understanding before investing. Join meet-ups and clubs with similar interests to learn from one another. For example, in our market, there are real estate investment clubs (REIAs) that have meetings monthly with guest speakers for around $20 per meeting.

9. Live Below Your Means

This one is a mind bender. Most people scrimp and chase after pennies on the sidewalk during college, and once you land your first real job you can’t wait to stop living like a pauper. The marketing machine is telling you to match your new-found income with material excess, “stuff”, and monthly expenses. Remember SAVINGS RATE and COMPOUND INTEREST discussion above? How much you make and your annual return isn’t as important as your savings rate and how early in your life you can start. You may just find more happiness with a minimalist lifestyle anyway and look forward to that Ferrari when you’re 60. 🙂

10. Take Care of Your Health

There is nothing worse for your financial freedom possibilities than excessive expenses associated with medical care, prescriptions, and lost productivity. No amount of wealth can compensate you for a run-down mind and body, and not feeling your best every day. Health and financial success are both governed by your ability to discipline the “self”. Work on maintaining high energy and health in your mind and body; if you have to spend money on fitness coaches – do it! This is equal in importance to financial education, and many of the young and ambitious underestimate its importance.

Summary

Financial freedom can be achieved by anyone; regardless of the size of your bank account at this moment. Start an open internal dialogue and pay attention to your thoughts about money. Thoughts are the first building blocks to changing your character and developing a financial free mindset. Then developing these 10 freedom habits will get you to the finish line!