Ok, I do admit I watch my fair share of Bloomberg, Yahoo Finance, and several other financial news outlets in my spare time. I am not a “trader” of any investments. I seek long term hold periods of everything I invest in, and try not to get caught up in the macro economic forecasting that dominates the media. But it’s hard not to get wrapped up in tickers on the screen flashing red and green at me while mezmorized by the latest stock that just shot up.

That being said, I have benefited from timing. We purchased more real estate in 2010-2018 than I’ve purchased in the last 5 years. I also enjoy purchasing shares of companies in my portfolio during times of distress and market corrections when prices are artificially low. I am at the core an investment bargain shopper that wants to know if we are about to see prices that look compelling. Even if you see bargain prices everywhere, you need to have “dry powder” to take advantage of the deals.

What is a recession? According to Investopedia:

“A recession is a significant, widespread, and prolonged downturn in economic activity. A common rule of thumb is that two consecutive quarters of negative gross domestic product (GDP) growth mean recession, although more complex formulas are also used. “

Although recessions impact different asset classes in different ways, let’s just assume there will be bargains in real estate, equities, debt, etc. if there is one coming in 2024. If you watch enough investment media, you will hear many opposing macro arguments from very smart people.

So what does the solo investor do to establish a macro base case thesis to plan for 2024 and beyond?

What does your “gut” say?

The last real recession was 2008-2009 and it was a bad one. Domestic product declined 4.3%, the unemployment rate doubled to more than 10%, home prices fell roughly 30% and at its worst point, the S&P 500 was down 57% from its highs. Since the end of World War II, the U.S has suffered through 12 recessions, or an average of one every 6.5 years. The last economic expansion, starting at the end of the Great Recession, lasted 128 months.

By that measure, we were overdue for an economic retraction when the Pandemic Recession hit. The pandemic “recession” only lasted several months and the economy was rescued by trillions of dollars of money printing and stimulus sent out to individuals and businesses. In my book, that is not a true recession.

So here we are, 14 years after the last real recession and historically they have occurred every 7 years. And without doubt, the pandemic injected trillions into the economy that have been slow to burn off.

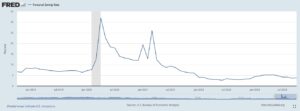

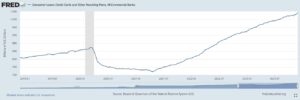

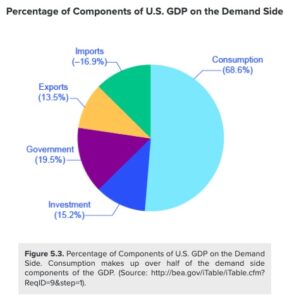

So let’s look at 3 charts: Personal Savings Rate as a percentage of disposable personal income, Credit Card use, and Consumption as a percentage of GDP.

Disposable Personal Income is after all taxes are paid. We are currently at 3.8%, which is the lowest we’ve seen since 2008 which kicked off the last recession. So Americans are running out of income to fund their current lifestyle. Which leads me to the next chart.

This chart shows in billions the total credit card debt and other revolving plans held by commercial banks. Now over 1 Trillion in debt! So you can easily see from these two charts that credit cards have been funding more and more of U.S. consumption.

And last you can see that 70% of the U.S. GDP is dependent on consumption spending.

The trends appear pretty obvious, right? Personal savings is trending down and to the right. Credit card debt is trending up and to the right. And 70% of our GDP is reliant on consumption.

How much credit card debt capacity is there in the U.S.? I looked for this figure but couldn’t come up with it. If we knew how much capacity there is, we could figure out an estimate of how long it would take to max out credit cards and the resulting drop-off of consumption. Even if we knew that, we wouldn’t be able to guess the lending institutions appetite for lending even more money.

We also can’t predict this Federal Reserve, the governments ability to raise debt ceilings and fiscally stimulate the economy, or a miriad of other variables. But we must develop a plan, and sticking our head in the sand is no way to respond to uncertainty.

Here’s how I look at it:

- Any large new long term investments must be “hell yeah”. An example of this is building units in San Diego which can deliver 15-20% return on invested capital.

- Short term investments 6 months to a year in duration must be liquid with a low probability of losing principle. An example of this would be a 12% deed of trust investment.

- The last U.S. Treasuries I purchased were 90 day term and yields above 5%. This strategy allows you to keep your return above the inflation rate, zero risk of principle loss, and still have dry powder that turns over every 90 days for a buying opportunity.

- When a recession comes and creates opportunity in the market, I plan to liquidate #2 and #3 above and gorge myself on the best quality real estate and companies that I can buy.

Do I think there will be a recession in 2024? Absolutely. Have I been wrong before? Absolutely.

But I have a plan to execute in either case that will result in exemplar returns.

What’s your plan?

Please smash the “like button” or leave me a comment if you found this information useful.

Best,

Derek

Derek Petersen

Chief Compounding Officer

Aviara Capital Investments

www.AviaraCapitalInvestments.com

www.linkedin.com/in/derekpetersen

Disclaimer: I am a financial independence guy and a financial freedom hack. I am not a financial advisor, a CPA, or a broker of anything. I recommend discussing financial decisions and/or planning with the professionals.